How is it that however well we plan, there’s guaranteed to be an unexpected expense at some point during the month. Funny that, because there’s never an unexpected windfall to balance it out.

Some expenses are small and can be soaked up using cash reserved for treats or by cutting back a little. Unfortunately, not all bills are small and there comes a point where it’s too much money to fork out from a single pay packet.

Most bills require urgent attention and usually need to be paid within a couple of weeks at most — so what options do you have if you haven’t got spare cash to hand?

The Bank of Mum ‘n’ Dad

Family and friends might be able to help with money problems. Although undoubtedly the cheapest option you’re going to find, it’s also my least favourite, as it can put people in compromising positions and lead to awkward situations. Do you really want to divulge your financial situation to others anyhow?

Use credit cards (wisely)

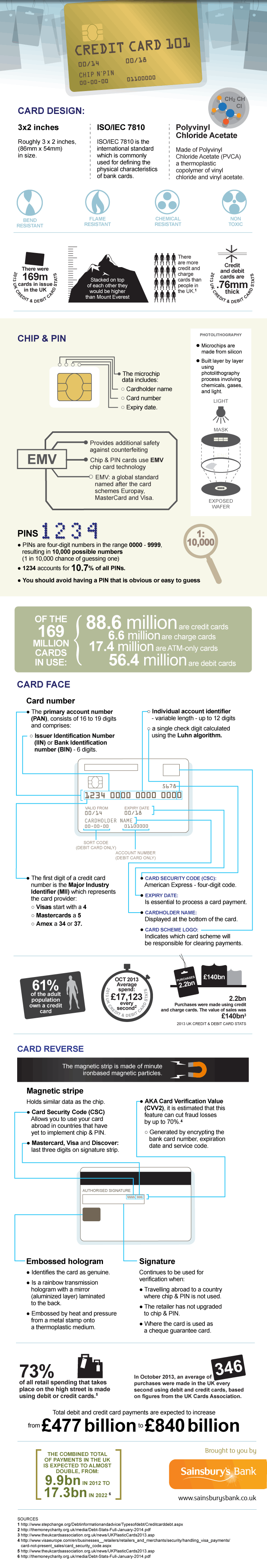

If you have a credit card with enough credit available then you’re onto a winner – just make sure you have a solid plan to pay it back as soon as possible.

Draw up a schedule of repayments for yourself, including interest – and stick to it! Here’s an interest calculator you can use.

Remember, credit card interest is among the highest you can pay, so don’t let the debt linger any longer than necessary.

Take advantage of your overdraft facility

An authorised overdraft might be an option, but don’t even think about allowing you account to go overdrawn if have no arrangement in place with your bank, because unauthorised overdraft charges can be financially crippling.

Like with credit cards, clear the balance as quick as you can. Not only will you save on fees, you’ll be in a better position to deal with the next financial emergency when it inevitably comes.

Take out a short-term 3 month loan

A short-term 3 month loan could provide a lifeline if you don’t have any other kind of backup in place.

Websites like Instant Lolly provide 3 month loans, help you shop around and get cash in your bank in under an hour.

It’s a good option if you’re bad at managing your finances. When you take out a short-term loan, the lender will organise to take repayments automatically, so all you need to do it ensure you have enough funds to cover the cost of the three instalments.

If you’re a spendaholic, ensure you schedule repayments just after your pay dates so you’re not tempted to blow the money on a big night out first.

Put yourself on a financial diet

Whichever solution you decide is right for you, its’ a good idea to put yourself on a financial diet until you pay the debt off.

I’m not suggesting you cut back on essentials, but we all tend to spend frivolously on something or other without necessarily realising it. Add up last months non-essential spending, you might be surprised!

Nor do you need to do without completely — just think up some creative solutions instead.

For instance, if you normally have a couple of takeaways per week, cut down to just one and cook cheaper, healthier meals at home the rest of the time. Better still, suggest a catch up with parents or friends and invite yourself round for tea at their house once in a while — not too often though — they might catch on :-).